For Download Stamp Duty Calculator App Click here

Comprehensive Guide to Gujarat Stamp Duty Calculator

Welcome to our complete guide on the Gujarat Stamp Duty Calculator. This guide covers each calculator type available on this platform, including lease agreements, commercial properties, residential properties, mortgages, agricultural and non-agricultural land, and row houses/bungalows. Each calculator is explained with detailed inputs, calculation formulas, and guidelines according to the Gujarat Stamp Act and Jantri Guidelines.

1. Lease and License Calculator

The Lease and License Calculator is designed to estimate total rent over a lease term, including any escalation options.

Inputs:

Total Lease Year: The duration of the lease.

Yearly Rent: The annual rent amount.

Premium and Tax: Additional charges associated with the lease.

Escalation by Year/Percentage: Options for annual rent increases.

Calculation Logic:

1. Total Lease Value =

2. Escalated Rent (if applicable):

Escalation by Year: Each year adds the escalated percentage.

Formula:

\text{Escalated Rent} = \text{Yearly Rent} \times (1 + \frac{\text{Escalation Percentage}}{100})^{\text{Years with Escalation}}

\text{Total Rent} = \text{Total Lease Value} + \text{Premium} + \text{Tax} ]

Stamp Duty Calculation:

Stamp duty for lease agreements is calculated based on the total rent and term length according to the Gujarat Stamp Act.

2. Commercial Shop Calculator

This calculator is used to estimate the value and stamp duty for commercial shops based on area, location, and amenities.

Inputs:

Property Type, Floor, and Frontage: Determines valuation based on the type and location of the shop.

Built-Up Area, Terrace, Parking Area, Open Land: Each area type has a separate Jantri rate.

Depreciation Years: Adjusts the value based on the age of the property.

Calculation Logic:

1. Area-Specific Calculations:

Built-Up Area Value =

Terrace Area Value =

Parking Area Value =

Open Land Value =

2. Depreciation Adjustment (if applicable):

\text{Depreciated Value} = \text{Total Value} \times \left(1 - \frac{\text{Depreciation Years}}{100}\right) ]

3. Total Property Value:

\text{Total Property Value} = \text{Built-Up Area Value} + \text{Terrace Area Value} + \text{Parking Area Value} + \text{Open Land Value} ]

Stamp Duty Calculation:

Stamp duty is calculated as a percentage of the total property value as per Gujarat Stamp Act guidelines for commercial properties.

3. Flat/Apartment Calculator

This calculator assesses the value of a flat or apartment, including adjustments for location and amenities.

Inputs:

Lift Availability and Floor Number: Impacts the premium value for properties on higher floors.

Built-Up Area, Terrace, Parking, and Open Land: Each area type has a separate Jantri rate.

Depreciation: Adjusts the property’s value based on its age.

Calculation Logic:

1. Area-Specific Calculations:

Built-Up Area Value =

Terrace Area Value =

Parking Area Value =

Open Land Value =

2. Premium for Larger Built-Up Areas:

If the built-up area exceeds 200, apply a 20% premium:

\text{Total Property Value (with premium)} = \text{Total Property Value} \times 1.2

Stamp Duty Calculation:

Calculated as 4.9% of the Total Property Value, plus an additional 1% registration fee.

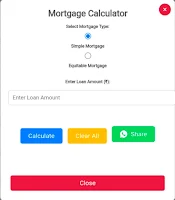

4. Mortgage Calculator

This calculator helps estimate stamp duty for both simple and equitable mortgages.

Types:

Simple Mortgage

Equitable Mortgage

Input:

Loan Amount: The principal loan amount.

Calculation Logic:

1. Simple Mortgage Stamp Duty:

For loans up to ₹10 crore:

\text{Stamp Duty} = \text{Loan Amount} \times 0.35\%

\text{Stamp Duty} = \text{Loan Amount} \times 0.70\% \quad (\text{max limit: } ₹11.2 \text{ lakh})

For loans up to ₹10 crore:

\text{Stamp Duty} = \text{Loan Amount} \times 0.25\%

\text{Stamp Duty} = \text{Loan Amount} \times 0.50\% \quad (\text{max limit: } ₹8 \text{ lakh})

3. Registration Fee:

For loans ₹1-5 lakh: 1% of loan amount.

For loans above ₹5 lakh: Fixed ₹5000.

5. Agri/Non-Agri Open Land Calculator

This calculator calculates the value of agricultural or non-agricultural land based on multiple survey numbers and Jantri rates.

Inputs:

Area and Jantri Rate for each Survey Number: Users can select multiple survey numbers.

Calculation Logic:

1. Total Land Value Calculation for Each Survey Number:

\text{Survey Land Value} = \text{Area} \times \text{Jantri Rate for Survey} ]

2. Total Property Value:

Sum the values of all survey numbers:

\text{Total Land Value} = \sum (\text{Survey Land Value})

Stamp Duty Calculation:

Based on the total land value, with distinct rates for agricultural and non-agricultural land.

6. Row House / Bungalows Calculator

This calculator calculates the stamp duty for row houses or bungalows by accounting for plot area, constructed area, terrace area, and depreciation.

Inputs:

Total Plot Area, Constructed Area, and Terrace Area: Each has a separate Jantri rate.

Depreciation Years: Adjusts the final value.

Calculation Logic:

1. Area-Specific Calculations:

Total Plot Value =

Constructed Area Value =

Terrace Area Value =

2. Depreciation Adjustment:

\text{Depreciated Value} = \text{Total Property Value} \times \left(1 - \frac{\text{Depreciation Years}}{100}\right) ]

3. Total Property Value:

\text{Total Property Value} = \text{Total Plot Value} + \text{Constructed Area Value} + \text{Terrace Area Value} ]

Stamp Duty Calculation:

Calculated as a percentage of the total adjusted property value.

Conclusion

This guide consolidates all calculators with the respective logic and formulas required for each calculation. Using the Gujarat Stamp Act and Jantri Guidelines, this platform ensures precise results for each property type. These calculators simplify complex property evaluations, enabling users to understand and calculate stamp duties effectively.

This structured article will provide your readers with a comprehensive understanding of each calculator and its application. Let me know if there’s anything specific you’d like to add or adjust.

For Download Stamp Duty Calculator App Click here

No comments:

Post a Comment